GETTING PAID FASTER

When Invoice2go first launched, it was a platform for business owners to create and send documents such as invoices and estimates. We quickly realized that there was an opportunity to help business owners get paid faster by accepting online payments.

I worked on this initiative from the ground up. We built a payments product that helped our business owners get paid faster and generated a new revenue stream for the company.

OUR GOAL

Our goal was to help small business owners focus on their business, by removing the stress and time spent chasing down payments. We believed that creating a way for customers to pay a business owner online for their service would help streamline the payment collection process. Additionally, we hypothesized that this would help business owners get paid faster.

High level goals:

Create a simple and easy way for a business owner to turn on online payments/ manage their payment preferences.

Design a payment portal for a customer to pay the business owner (web/mobile web).

Offer multiple payment methods to increase the likelihood of customer making a payment.

MY ROLE

I worked as the lead designer for the payments team.

This was a new initiative for the company so I partnered closely with two PM’s and conducted research studies to define the customer pain point we were solving.

I was responsible for the interaction design, visual design, conducting prototype testing, and user research.

what we learned

We conducted both a quantitative survey study with 10,000 business owners, and qualitative interviews to solidify our understanding on how to build the payments product.

60% of business owners said that online payments would be helpful to their business

Win more business

Make it easier for them to get paid

80% of business owners said that the invoice amount would determine if they would allow online payments or not

Invoices more than $2000 had a less likelihood of being paid online

Transaction fees were the number one reason why a business owner would not use online payments

What customers said…

For the sake of user privacy, I have omitted the actual names of each business owner

“I get a lot of clients asking me if they can pay me online, embarrassingly...I have to say no... ”

“I think I could win more business if I had the option for clients to pay me online”

“How much will I have to pay in transaction fees? How does that work? I don’t know if I can afford it...”

“I want to make sure my invoice is on there. It reflects my brand...”

workshop

I conducted a cross-functional workshop to create alignment on what we were going to design and build. The session was guided from our research and was broken down into two parts: (1) 1 hour spent on mapping pain points and user stories, (2) idea generation on potential design solutions.

Kicked off a workshop with a cross-functional team of 8, 1 hour spent on mapping pain points and user stories, 1 hour spent on idea generation within teams, Outcome was alignment on initial MVP and several design directions to explore.

Interaction Design

a/b testing

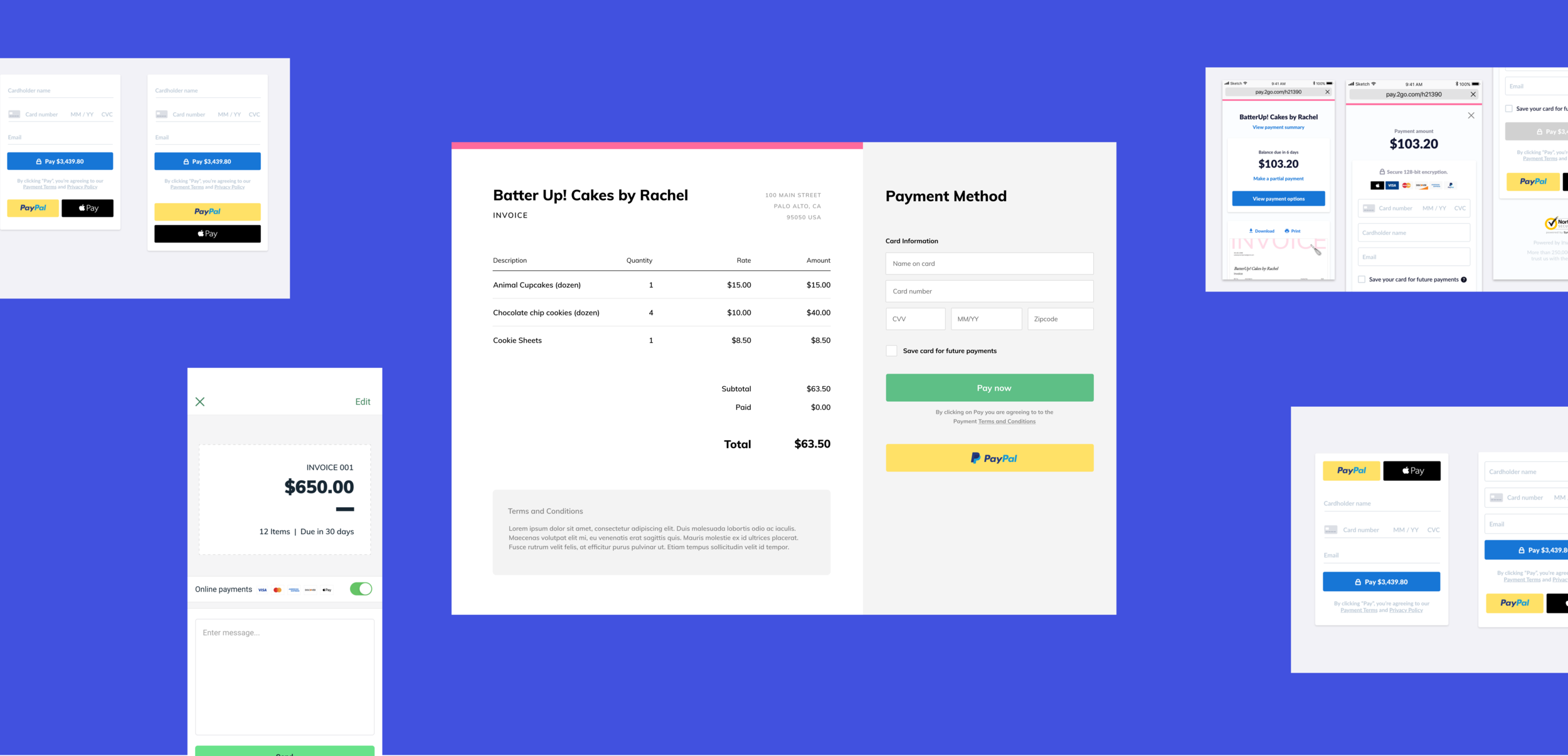

During the design process, we decided to test variations on two parts of the payment page: (1) credit card form layouts, and (2) different ways to represent business owner branding.

launch designs

Within the invoice creation flow we added a toggle to enable payments

Stripe was our payment processing partner, and so we triggered a dialog to connect with Stripe if the business owner turned on payments for the first time

We created a global setting to manage payment preference. Some business owners only wanted PayPal versus credit card so we needed to accomodate that flexibility.

mobile web payment page

web payment page

post launch learnings

After completing the designs and development of the MVP of our payments product, the metrics were not quite what we expected:

Enablement rate was only 17%, we initially hypothesized closer to 40%

We had about 70% of customers navigating to the payment page but only 27% were actually completing a payment.

why was enablement low?

Working closely with analytics we started to discover more about invoicing behavior and how that impacted our enablement rate for online payments.

How we assumed business owners were invoicing:

What data told us they were doing:

We learned that our initial assumption on how quickly business owners were invoicing regardless of having payment options or not, was wrong. In fact, the invoicing process could last the lifetime of the job. A business owner would frequently go back and forth between an invoice and constantly add new line items as the job went on. We also learned that business owners were not thinking about how they wanted to get paid while they were still editing an invoice. In fact, after speaking to business owners we discovered that by the time they were ready to send the invoice the option to turn on payments was buried at the bottom of the screen and was easily forgotten.

design solution

Draft state: We created a draft state in which a business owner could constantly edit the invoice and come back to until the invoice was complete.

Send state: When the invoice was ready the business owner would save it and go to a send screen. This is where we added the option to turn on payments. From our research, it was at this stage when a business owner was thinking about how they wanted to get paid, and thus surfacing the toggle here was more contextual.

After making this change we saw an increase in

enablement rate from 17% to 38%.

improving pay rate

Similar to our process for understanding why the payment enablement rate was so low, we also dove into the data to understand why we had a large number of customers hitting our payment page, but so few actually paying.

Our first assumption was that people were getting distracted by the information on the invoice displayed to the side of the payment methods. So, we decided to remove the invoice and simplify the screen to only show the payment methods.

We saw a slight increase in pay rate from 27% to 31%

removing the noise

We quickly realized that removing the invoice from the payment page, while showed a slight increase in pay rate, was causing us more harm than good.

We noticed an influx of support tickets from business owners complaining that their customers could not see their invoice when trying to pay.

Instead we decided to put the invoice back into the page, but optimize the way the invoice was being shown.

We removed a lot of unnecessary information that the original invoice had and just put information that a customer needed to feel confident to pay:

What they were paying for

Previous payments

Any specific instructions from the business owner

we saw an increase in pay rate from 31% to 48%

final outcome

We iterated constantly on the payment page to test different layouts and fix usability bugs we discovered

We saw that business owners who accepted online payments were getting paid on average 14 days sooner

Within 12 months we grew the intial payment volume to processing $30 million in payments a month

Added the following features post initial launch:

Payment reminders

Payment schedules

MPOS payment solution with PayPal readers

Accepting deposits on estimates

Financing options for business owners and their customers